Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 23.04.2025

EURUSD

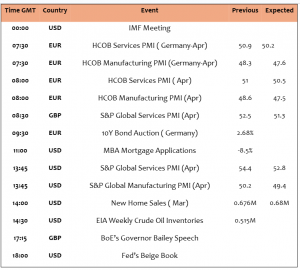

EURUSD traded weaker today & fell to $1.1379 after USD index slightly recovered. Strength of EUR by more than 5% vs USD in a month was mainly due to USD weakness as EZ economic fundamentals showed no change nor improvement, what does that mean? It simply means that the markets’ sentiments may change quickly even if the Fed starts reducing the rates which was almost priced in. PMI numbers in services & manufacturing from EZ, Germany & France are due for today, keep an eye on these numbers.

Technical correction would be highly probable, targeting $1.1490 then $1.1455 , which exactly what happened , $1.1335 will be the next target ( correction). 1H RSI is approaching from oversold , quick recovery to $1.1410 will be possible.

USDJPY

Second day of recovery, USDJPY gained today & advanced to 142.12 after losing more than 1% on Tuesday. President Trump said yesterday that he has no intention to remove Fed Chair Powell, giving relief to the markets including USD index. Services PMI in Japan improved in April to 52.2 after contraction in March. Keep an eye on PMI numbers from the US later today & fluctuations of US bond yields.

Price action is still showing fragile correction, which means that the re-positioning is likely to be short-lived. Beware of the risky exposure with risky leverage. We think that the Strength of the Yen is not yet finished. Correction may continue to 143 amid mixed sentiments.

GBPUSD

GBPUSD was little changed today, trading slightly lower at $1.3303. All eyes will be today on BoE’s governor Bailey speech & PMI numbers in services & manufacturing , the weaker the numbers, the higher the probability of cutting the rates very soon.

1H trend index is somehow bearish while the daily remains bullish. $1.3250 is short-term support. $1.3360 is the next target for buyers. Mixed sentiments between bearish & bullish persisted in this pair.

GOLD

For the second consecutive trading session, gold fell & traded lower at $3312 per ounce after losing more than $150 since yesterday, which means more than -4% in loss. Strong volatility in gold market is likely to continue. What happened yesterday was that the US Treasury Secretary Bessent said he expects de-escalation in the trade conflict with China very soon, at the same time President Trump clarified that he has no intention to fire the Federal Reserve Chair Powell, giving reasonable justification to buy again USD & high-risk assets. Gold is still up by 26.3% in 2025.

We have said yesterday that correction to $3430will be possible which exactly happened yesterday. Daily trend index remained strongly bullish, hourly index is bearish now. Forecast poll showed bearish attitude by 67% of the traders. $3290 will be the next support.

SILVER

Unlike gold, Silver advanced & traded higher today by almost 1% at $32.77 per ounce after falling by 1% on Tuesday. Keep an eye on the developments of the trade conflict between the World’s largest two economies, if the trade tensions start to easy soon according to US Treasury Secretary, then silver is likely to benefit . We watch closely PMI numbers in manufacturing from the US, EZ & UK later today.

Mixed sentiments persisted amid neutral RSI indicator. $32.10 is support. $32.90 is the next resistance for day traders which is approaching now, then $33.10.

Oil-WTI

Crude oil prices gained & traded higher for the second consecutive day, WTI $64.60PB, Brent $68.63PB. According to API, US weekly crude oil inventories dropped by 4.6 million barrels last week, the largest fall since November, EIA will release the weekly inventories later today. The main reason for oil’s strong performance in the last two days was that US imposed new restrictions on key Iranian figures involved in crude shipping. Easing the tensions between China & the US is likely to have positive impact on oil market, at least in the short-term.

Monthly forecast poll showed bullish bets on WTI & expected an increase to $66.38PB. Price action supports now further advance but slow to $64.35PB ( executed today ) before heading to $66. $62 is support for day traders.

DAX40

After it closed higher by 0.4% on Tuesday, German DAX index futures traded strongly higher today & advanced by more than 2.5% to 21850, following the same trend of the US equities. German auto makers gained, Mercedes 2.5%, BMW 2.1% and Porsche 2.5%. Germany’s PMI numbers in services & manufacturing are due today. Keep an eye on Germany 10Y bond auction as well, it will show how the markets absorb the short & long term risks & inflation expectations.

21090 & 20500 are support levels, 21500 will be the next target ( resistance & executed today), then 22400.

NASDAQ

US stock futures traded strongly higher today after strong performance on Tuesday, Dow Jones 2.6%, SPX500 2.5% & Nasdaq gained 2.7%. Busy day ahead from America with release of US new home sales, PMI numbers in services & manufacturing, not to forget Fed’ beige book as well. US Treasury Secretary Bessent clarified that the de-escalation of the trade tension with China will happen very soon & the tariffs with China can not be sustained as well. In the meantime, President Trump said that the tariffs on China’s exports to America will drop in the two countries reach a deal.

Price action is heading higher today ( correction) & targeting 18100 then 18350, both are executed then 18900. 17600 is support ( could happen again). Volatility remained high.

BITCOIN

As markets’ dear index fell, the appetite for risk assets gained momentum again including crypto assets that gained today, BTC $93642, Eth 2%, Cardano 2.5% & Ripple 1.1%. Bitcoin is trading at the highest level since March 3rd . Tesla reported holding $951M in Bitcoin holdings at the end of the first quarter, holding almost 11509 BTC.

$86800 is support, however markets’ sentiments still support further advance to $90600 ( execyted ) , then $94K. Both, daily & hourly trend index remained bullish.